Table of Content

This information is of a general nature and has been prepared without taking account of your personal objectives, financial situation or needs. Before acting on the information, you should consider whether the information is appropriate for you having regard to your objectives, financial situation and needs. Life insurance You never know what tomorrow may bring, but with life insurance you can continue to look after your loved ones even if you aren't there.

Lifetime guarantee on repairs to your building by an ANZ authorised repairer, builder or supplier. Emergency accommodation offered for up to 24 months if your house is destroyed in a catastrophic event. You'll be redirected from anz.co.nz to the quote tool on Vero's website. To get a quote, you'll be redirected from anz.co.nz to the quote tool on Vero's website. Up to $80,000 to repair or rebuild retaining walls on your property caused by a sudden and unforeseen event. We’ll help you choose the right insurance for your needs and budget, or put you in touch with a specialist who can help.

Why choose ANZ Home Loan Protection?

No member of the ANZ or its related companies or any other person guarantees Cigna or any of the products issued by it. Home insurance covers the cost of repairing or rebuilding your home following an insured event. This includes natural disasters, such as a bushfire, flood, earthquake or storm, as well as theft and vandalism with accidental breakages as an optional extra. Ourfinancial advice provider statementhas some important information you should know about ANZ and our financial advice services. All ANZ Asset Protector policies are underwritten and issued by Vero Insurance New Zealand Limited and distributed through ANZ Bank New Zealand Limited . No member of ANZ or its related companies or any other person guarantees Vero or its subsidiaries or any of the products issued by them.

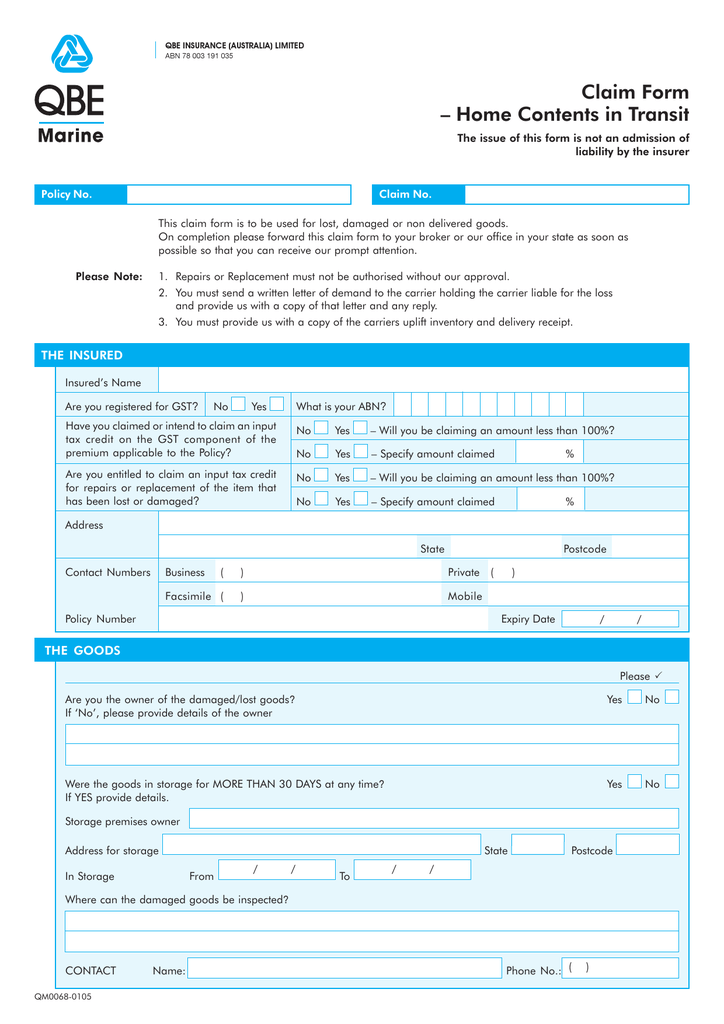

You can make a house or contents insurance claim online through the Vero Claims Portal. You’ll need your ANZ policy number, details of what’s happened and the people involved to hand. Contents insurance covers the cost of replacing what’s inside your home if it’s damaged, lost or stolen.

Income protection

Loss or damage caused by or arising from any business or income earning activities being conducted at the site (except a home office or surgery taking up less than 20% of the home). Loss or damage caused by any event that doesn’t occur within your insurance period. If your home has been damaged, make sure everyone involved is safe and, if you need to, call emergency services. For example, if there has been a theft, burglary or vandalism, or an attempt at these, call the police immediately.

Up to $3,000 for gradual damage to your house caused by leaking or overflowing from internal water pipes. We understand the risks businesses face each day, across a broad range of business types. That’s why we’ve partnered with trusted providers in the insurance industry to offer a range of covers to suit your needs.

Great reasons to choose ANZ

You’re covered up to the sum insured amount you choose, plus GST. ANZ has entered into a long-term strategic alliance agreement with Zurich. ANZ receives a commission of premiums from the sale of Zurich insurance products from Zurich in accordance with prescribed caps and clawback requirements. If you want to make a claim for ANZ Life Insurance, ANZ Income Protection, ANZ Recover Well, ANZ 50+ Life Cover, or ANZ Accident Cover Plus, we have support available over the phone or via email. Please note these products are no longer available for new customers, and as of April 2022 are Zurich branded . Get cover to replace your valuables if they’re damaged, lost or stolen with contents insurance.

We’ve partnered with some of New Zealand’s leading insurance specialists to offer comprehensive, flexible and affordable options. Protecting your income, life and lifestyle gives you and your loved ones peace of mind, should the unexpected happen. Having the right insurance in place can keep your business running if the unexpected happens.

Extra tips and tools to help you buy a home

ANZ lending criteria, terms, conditions, and fees apply. ANZ Life & Living Insurance is underwritten and issued by Cigna Life Insurance New Zealand Limited and distributed through ANZ Bank New Zealand Limited . For more details, including copies of policy documents, contact any ANZ branch.

Take out a new ANZ Home Loan of $100,000 or more and you could get a cash contribution of 1%, up to a maximum of $20,000. New home loans must be approved and documented by 31 March 2023, and the cash contribution is conditional on keeping your home loan with ANZ for at least three years. Find out about buying, building or renovating and how you could pay off your loan faster. We also have ways to help you make your home more energy efficient too. This cover could help with living expenses, repaying debt, or support your recovery.

If you are unsure you should get independent advice before you apply for any product or commit to any plan. Get a multi-policy discount when you sign up for both house and contents insurance with ANZ. ANZ Mortgage Protection Product Disclosure Statement and Policy Document before deciding whether to continue to hold this product. You pay your premium monthly in advance by direct debit from a bank account or credit card. ANZ Home Loan Protection is optional insurance that can pay your ANZ Home Loan and help maintain your home lifestyle - when you can’t due to unexpected unemployment, illness, injury and more. Try the online estimate tool to understand how much this cover may cost.

If you’re a homeowner or a renter, ANZ Asset Protector – Contents will replace or repair your belongings if accidentally lost or damaged, anywhere in New Zealand. Once you're ready to apply for ANZ Home Loan Protection, simply request a quote and we'll call you back to provide a formal quote. You can also visit your nearest branch to get a quote and apply. Before taking out any type of insurance it's important to make sure that you have the financial capacity to pay your premiums. Your monthly ANZ home loan repayments for up to 90 days, if you become involuntarily unemployed.

Read our FAQs on what may be covered, rental income protection, holiday rentals and more. We no longer offer this insurance product to new customers however if you’re an existing policy holder you remain covered by this insurance. If your building is totally destroyed by an insurable event and your claim is accepted, we’ll choose to either rebuild or pay you the cash equivalent. Full building replacement cover will apply unless the buildings are in a dilapidated condition at the time of a claim.

Your monthly ANZ home loan repayments for up to 18 months, if you can’t work because of illness or injury. A one-off payment that pays your ANZ home loan if you pass away or are diagnosed with a terminal illness with less than 12 months to live. Natural disasters like bushfires, floods, cyclones and hailstorms are inevitable. See our top tips on getting your home covered from disaster.

Browse and apply for home or life insurance in the ANZ App . There's no room for guesswork when it comes to insuring your property and the belongings that make your house a home. Depending on your situation, you may need to purchase home insurance before settlement, as a condition of your home loan. If you need to make a claim on your insurance policy, it's important to start the process as soon as you can.

Protect the things you own from accidental damage or loss. Keep a copy of your estimate – you will need to provide this at claim time. Get a complete and accurate rebuild cost estimate for your home via the Cordell SumSure calculator or a qualified professional. Loss of rent for up to 8 weeks due to tenants legally withholding payment or if the tenant vacates without giving required notice.

No comments:

Post a Comment