Table of Content

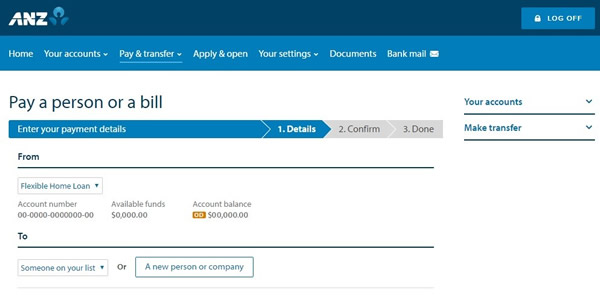

Browse and apply for home or life insurance in the ANZ App . There's no room for guesswork when it comes to insuring your property and the belongings that make your house a home. Depending on your situation, you may need to purchase home insurance before settlement, as a condition of your home loan. If you need to make a claim on your insurance policy, it's important to start the process as soon as you can.

Up to $3,000 for gradual damage to your house caused by leaking or overflowing from internal water pipes. We understand the risks businesses face each day, across a broad range of business types. That’s why we’ve partnered with trusted providers in the insurance industry to offer a range of covers to suit your needs.

Re-fix your home loan

You must decide whether the estimate provided by the Cordell Sum Sure calculator is appropriate or if you should use an alternative sum insured amount based on your knowledge of the property. We do not cover loss or damage caused by a bushfire or grass fire, flood or named cyclone that occurs within 48 hours of the start of your policy. If your building is totally destroyed by an insured event and your claim is accepted, we’ll choose to either rebuild, repair or pay you the cost to do so. We won’t cover loss or damage as a result of an earthquake or tsunami if the loss or damage occurs later than 72 hours after the earthquake or tsunami occurring. Excesses, terms, conditions, limits and exclusions apply to these policies.

Get covered for repairing or rebuilding your home after an insured event. Help protect your lifestyle and financial wellbeing if you couldn't work due to injury or illness with income protection. We are an independent comparison platform and information service that aims to provide you with the tools you need to make better decisions. While we are independent, we may receive compensation from our partners for featured placement of their products or services.

ANZ House and Contents Insurance Review

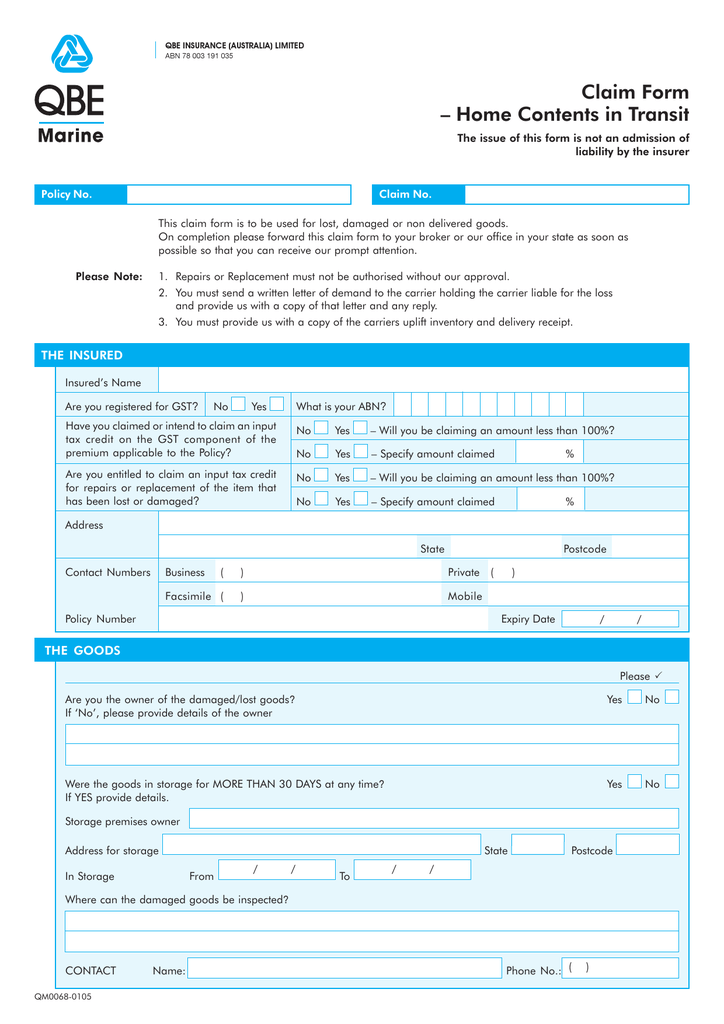

Loss or damage caused by or arising from any business or income earning activities being conducted at the site (except a home office or surgery taking up less than 20% of the home). Loss or damage caused by any event that doesn’t occur within your insurance period. If your home has been damaged, make sure everyone involved is safe and, if you need to, call emergency services. For example, if there has been a theft, burglary or vandalism, or an attempt at these, call the police immediately.

Get an idea of how much it might cost based on some quick questions about your home and renovation plans. You’ve worked hard to get your house – insurance can help you protect it. You choose the amount of cover you want, up to the maximum of $4,000 per month for up to 180 days. You choose the amount of cover you want, up to the maximum of $4,000 per month.

Free Property Unlocked webinars

With SumExtra, Vero will pay the full replacement cost to repair or rebuild your house – even if it’s higher than your sum insured. This is unless the damage is caused by a natural disaster . House insurance with optional extras to suit your situation. Listed below is a summary of the cover and features that may be available.

Please appreciate that there may be other options available to you than the products, providers or services covered by our service. ANZ offers customers a multi-policy discount, which means if you take out two or more eligible insurance policies you’ll receive a discount on your premium. House, contents, boat and car insurance policies are eligible for this discount. There are certain events that ANZ won’t pay out for should you make a claim, known as policy exclusions.

Policy documents

Price range estimates may change daily and the actual sale price may be different. Get detailed property and suburb information to help you plan when buying, selling or refinancing. If you're taken ill or have an accident, our critical illness cover, ANZ Recover Well, helps to reduce the financial stress on you and your family.

An additional $2000 payment if your house is mortgaged with ANZ and suffers a total loss that’s covered by the policy. This calculator tool provides you with a summary list of common household items and their values, based on an average and above average three bedroom New Zealand home. Simply enter the value of your household items and the tool will calculate the total value of your home contents, helping you to determine the level of contents cover needed.

Includes a funeral benefit, which provides an advance payment of $10,000 of your Life Cover to help pay for funeral-related expenses. The Life Cover amount is reduced once the funeral benefit is paid. You’ll be redirected from anz.co.nz to the quote tool on Cigna’s website. Make sure you assess your own situation when completing this contents checklist. Our customer service team is your first point of contact for any enquiries, raising concerns or providing feedback. We will do our best to resolve your concerns genuinely, promptly, fairly and consistently, and keep you informed of the progress.

Zurich has adopted the Life Insurance Code of Practice , which contains minimum standards of service that customers can expect from insurers. Persistently high inflation could see back-to-back increases to the cash rate, according to a new Finder poll. A crypto-take on the popular real-time strategy genre, Hash Rush. After you’ve reported your claim Vero will be in touch within two business days to advise what happens next. If you buy the policy on a new ANZ loan, this is the date ANZ makes funds available to your ANZ loan.

Remember, it's always best to check your level of contents cover each year as we all upgrade or acquire new things, so it's important to ensure your level of cover is adequate and kept up to date. ANZ Landlord Insurance is issued by QBE Insurance Limited and distributed by ANZ under its own license. If you’re unsure whether something falls under home or contents insurance, then imagine you tipped your home upside down.

You may be eligible for a multi-policy discount when you have two or more qualifying insurance policies with Vero . If your house is damaged, you could repair or rebuild it with house insurance. Make your life easier with all your banking and insurance in one place. The Cordell Sum Sure calculator is provided by CoreLogic NZ Ltd. The information and data used by the Cordell Sum Sure calculator may not reflect the specific details of your property and may not be complete, current or accurate. The estimated reconstruction cost may not reflect the actual cost to rebuild your home.

As well as your house, it includes things like damaged driveways, fencing, permanent swimming pools or spas, retaining walls (up to $80,000) and landscaping (up to $2,500). To get a quote, you’ll be redirected from anz.co.nz to the quote tool on Vero’s website.

No comments:

Post a Comment